By Nathan W. Tierney

Director of Value Management

and the Author of

Value Management in Healthcare

In healthcare, the overarching goal for providers, as well as other stakeholders, must be improving value for patients. Here, value is defined as the health outcomes achieved that matter most to patients relative to the cost of achieving those outcomes. Improving value requires either improving one or more outcomes without raising costs, or lowering costs without compromising outcomes, or both. Outcomes empower patients, clinicians, and payers and will influence the future healthcare delivery landscape in three distinct ways:

- Patients shall choose the providers for their care based on outcome value scores

- Providers shall be data-informed to make targeted improvements and learn

- Payers shall measure return on investment and direct patients to high-value providers

“The universal development and reporting of outcomes at the medical condition level is the single highest priority to improve the performance of the health care system”- from Redefining Health Care, by Michael E. Porter and Elizabeth O. Teisberg.

Problems Facing Healthcare Delivery Organizations

Globally, countries are investigating new healthcare delivery strategies to prioritize value-based outcomes over volume. National governments are introducing policies, implementing new reimbursement methods, and collaborating with health organizations to enact change. The new laser-beam focus on achieving the best health outcomes for patients at the lowest cost will transform the healthcare industry.

Companies are also interested in value-based outcomes. These companies are paying high prices for employee health data in order to predict risks and health needs. The implications for this situation are significant for employees, employers and insurers. As an example, if a company thought you were at risk for diabetes, it might offer you an incentive to join a weight-loss program or send personalized reminders to visit a doctor for a checkup. Employers do have a vested interest in healthy and productive employees as well as a fiduciary interest in what they pay for employee healthcare insurance, but does use of health-related data constitute improper use of employer and employee relationship?

From the Strategy that will Fix Health Care, by Michael Porter and Tom Lee:

“Provider organizations understand that, without a change in their model of doing business, they can only hope to be the last iceberg to melt. Facing lower payment rates and potential loss of market share, they have no choice but to improve value and be able to ‘prove it.’”

Recommendation for Healthcare Delivery Organizations

It is recommended that organizations create a Value Management Office to serve as a center of excellence for determining evidence-based outcome measurements. This facilitates the creation of value-based care and payment models. Value-based care and payment models support IT governance by evaluating business case investments and projected benefits to link people, processes, and technology. Patients and providers should work together to define and drive the industry towards value.

Implementation of a collaborative Value Management Office enables organizations to evaluate projected and realized strategic, operational, and financial benefits from major business process changes, and enterprise initiatives, and establishes critical value-based care models. The shared vision is for Healthcare Delivery Organizations to apply value management as a way of doing business to ensure efficient deployment of capital, improved clinical outcomes, and achievement of strategic, operational, and financial objectives.

Healthcare organizations are examining innovative ways to deliver improved patient outcomes at lower cost. This has involved traditional process improvement methodologies, which have been effective in reducing traditional defects and efficiency improvements. However, these efforts have failed to utilize new technologies, analytics and value frameworks that provide both horizontal and vertical alignment for value-based healthcare.

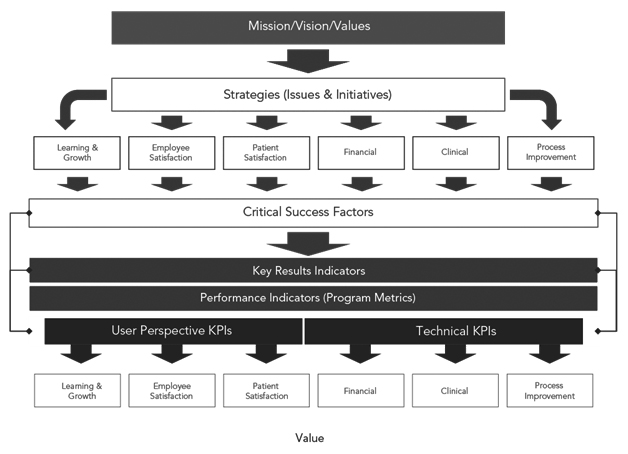

The Value Realization Framework provides the methodology for aligning Mission, Vision, and Values with concrete Critical Success Factors (agency goals), measurable Key Results Indicators (outcomes), objective and measurable Key Performance Indicators (actions). The methodology seeks to ensure quality of care, patient safety, and Health Information Technology Programs, which improves service delivery, product delivery, information security, fiscal management, clinical outcomes, and operational metrics (Figure 1).

This standards-based process also ensures present IT systems continuously perform as required, contribute to overall business goals, and delivery of expected outcome-oriented results.

Figure 2: Value Realization Framework

Conclusion

Primum non nocere, “First do no harm,” the Hippocratic Oath calls on the healthcare community to ethically uphold the highest standards of providing safe and quality care to those in need. This calling goes beyond minimizing mortality rates and instead requires standards with which to achieve a predictive outcome. A standard is something quantifiable and used as a measure or model in a comparative evaluation to determine the value of an outcome. Without standards, there can be no improvement, which is why establishing a center of excellence to determine outcome measurements is so critical. Only through establishment of a Value Management Office and a standards-based Value Realization Framework will Healthcare Delivery Organizations truly shift from reactive to proactive in the provision of value-based care. This shift is the catalyst for change within our healthcare system that empowers patients, clinicians, and payers by delivering desired clinical, financial, patient satisfaction, employee satisfaction, process improvement, and learning and growth outcomes from the perspective of the individual – not the institution.

If Value = Outcomes (Benefits) / Costs (Inputs), then the value story is providing any patient regardless of sex, age, race or location, a safe and quality health outcome relative to the cost of achieving those outcomes. A Value Management Office can help be the conduit for telling your organization’s value story.

Nathan Tierney is an accomplished senior executive and leader in value management, with over 21 years experience in multibillion-dollar domestic and international operations, developing innovative and profitable methodologies, advising disparate levels of leadership, and managing in complex environments.

He has a proven track record of performance in all fields, and a natural propensity to analyze outcomes both strategically and objectively while remaining pragmatic and focused. Information about Nathan's upcoming book, Value Management in Healthcare: How to Establish a Value Management Office to Support Value-Based Outcomes in Healthcare, can be found here.

_______________________________________________

i Porter, M. E., & Lee, T. H., MD. (2013). The Strategy That Will Fix Health Care. Retrieved October 12, 2016, from https://hbr.org/2013/10/the-strategy-that-will-fix-health-care

ii Adapted from International Consortium for Health Outcomes Measurement. 2012

ii Adapted from International Consortium for Health Outcomes Measurement. 2012

iii Maslow, A.H. (1943). “Psychological Review – A Theory of Human Motivation

iv Porter, M. E., and Teisberg, E. O. Redefining health care: creating value-based competition on results. Harvard Business Press. 2006

v Wired Magazine (2015). “Security this Week: Employers are Paying Data Firms to Predict Your Health Risks”http://www.wired.com/2016/02/security-this-week-employers-are-paying-data-firms-to-predict-your-health-risks/ Access February 20, 2016

vi Porter, M. E., and Thomas H. Lee. The Strategy that will Fix Health Care. Harvard Business Review. 2013

vii Adapted from International Consortium for Health Outcomes Measurement Intro Presentation. 2015